Blue Halo LLC

AeroVironment, Inc. and BlueHalo LLC announced the execution of a definitive agreement under which AV will acquire BlueHalo in an all-stock transaction with an enterprise value of approximately $4.1 billion, creating a more diversified global leader in all-domain defense technologies. The combined company will bring together complementary capabilities to offer a comprehensive portfolio of high-growth franchises, powered by cutting-edge technology and focused on addressing the most important priorities and needs of our nation and allies around the globe.

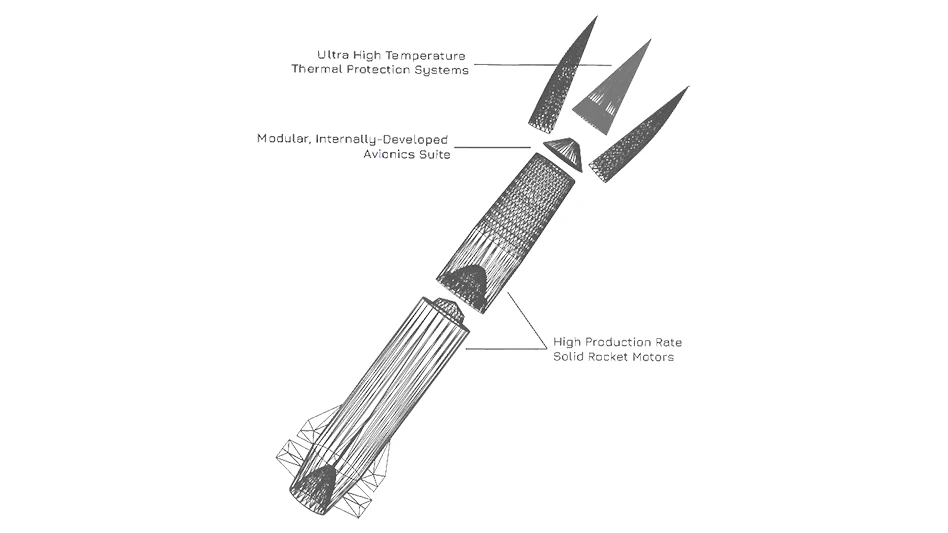

BlueHalo, an Arlington Capital Partners portfolio company, was founded as a purpose-built platform providing industry-leading capabilities in several key mission areas: Space Technologies, Counter-Uncrewed Aircraft Systems (cUAS), Directed Energy, Electronic Warfare, Cyber, Artificial Intelligence and other Emerging Technologies including Uncrewed Underwater Vehicles (UUVs). Since its founding in 2019, BlueHalo’s notable accomplishments include being the first to successfully operationally field directed energy (DE) laser weapon systems (LWS) with its LOCUST LWS, being awarded Space Force’s multi-billion dollar program to transform space operations with BADGER, its adaptive phased array product and serving as a leader in Radio Frequency Counter-Unmanned Aerial Systems (RF C-UAS), delivering its 1000th system last year with its Titan and Titan-SV systems. BlueHalo has focused on cutting-edge research and development allowing for the development of products and services to transform the future of global defense.

BlueHalo estimates it will achieve more than $900 million in revenues for 2024, in addition to funded backlog of nearly $600 million and a pipeline of multiple billion-dollar opportunities and programs of record. BlueHalo generated approximately $886 million of revenue in 2023, compared to $759 million and $660 million in 2022 and 2021, respectively.

The acquisition of BlueHalo will create a diversified Defense Tech company with a highly complementary and differentiated portfolio of solutions in Uncrewed Systems, short and long range Loitering Munitions, Counter UAS, Space Technologies, Electronic Warfare and Cyber, powered by AI and Autonomy. This combination will drive innovation, expand manufacturing capacity and enable us to better support our customers and their critical missions. AV expects that BlueHalo’s portfolio of 10 flagship solution families and more than 100 patents will seamlessly integrate with AV’s complementary existing expertise in the design, development, manufacturing, training and servicing of Uncrewed Systems, Loitering Munitions and Advanced Technologies. AV and BlueHalo believe that these synergies will primarily be identified as administrative and operational cost savings and sharing best practices from each company. The companies’ shared culture of agile innovation and mission expertise will enable the combined entity to develop and deliver next-generation technologies that will have significant military value and redefine the next era of Defense Technology. On a pro forma basis, the combined company is expected to deliver more than $1.7 billion in revenue.

“For more than 50 years, AV has pioneered innovative solutions on the battlefield, and today we are poised to usher in the next era of defense technology through our combination with BlueHalo,” says Wahid Nawabi, AV chairman, president and chief executive officer. “BlueHalo brings key franchises and complementary capabilities, as well as a wealth of technologies, diverse customers and exceptional talent to AV. Together, we will drive agile innovation and deliver comprehensive, next-generation solutions designed to redefine the future of defense. We are thrilled to welcome the talented BlueHalo team as we unite our strengths, expand our global impact and accelerate growth and value creation for AV shareholders.”

“BlueHalo was founded to address the most pressing challenges confronting the defense and national security community, from unconventional threats to near-peer adversaries,” says Jonathan Moneymaker, chief executive officer of BlueHalo. “We have pioneered solutions for drone warfare, distributed autonomy, and the need for more robust and assured access to space in an increasingly contested, crowded and competitive domain. Through these efforts, we have earned our reputation as a trusted partner in defense innovation. By uniting with AV, we are building an organization equipped to meet emerging defense priorities and deliver purpose-driven, state-of-the-art solutions with unmatched speed. Together, we remain committed to protecting those who defend us while driving the next generation of transformational advancements in defense technology.”

Benefits:

- Creates a diversified industry leader. This transaction brings together AV’s established portfolio of cutting-edge defense solutions with BlueHalo’s emerging and industry-defining technologies. This union will provide customers with a comprehensive suite of solutions across multiple domains—including air, land, sea, space and cyber. Together, AV and BlueHalo will create a leader in integrated defense technologies with a global footprint capable of addressing the full spectrum of modern defense.

- Increases agility and speed, with enhanced infrastructure, manufacturing capabilities and geographic footprint. The combined company will benefit from greater resources, enabling faster innovation and more efficient deployment

- of critical defense systems.

- Supports AV’s entry into additional key defense segments and builds on the Company’s strong track record of providing essential solutions. With BlueHalo’s portfolio, AV will enter into new segments that will significantly increase the Company’s total addressable market, including Counter-UAS, Directed Energy, Electronic Warfare, Cyber and Space technologies. The acquisition will bring with it BlueHalo’s key programs of record, deep customer relationships and strong backlog and pipeline, positioning the future company as a more robust and sustainable prime defense solution provider. This partnership will enhance AV’s ability to meet the evolving needs of the Department of Defense (DoD) and allied nations with a robust suite of innovative solutions.

- Diversifies mix of customers, products and revenue. The combined company is expected to achieve a more balanced and diversified customer base, product and revenue mix, benefiting from BlueHalo’s established presence in key emerging defense markets. The combined company will benefit from expanded geographical reach, with the ability to provide BlueHalo’s solutions to AV’s larger international customer base. By integrating complementary capabilities, AV will be well-positioned to generate sustained long-term value for shareholders.

- Generates attractive returns. AV expects the transaction to be accretive to revenue, adjusted EBITDA and non-GAAP EPS in the first full fiscal year post-close.

Transaction Details

The transaction, which has been unanimously approved by both companies’ board of directors or managers, is expected to close in the first half of calendar 2025, subject to regulatory and AV shareholder approvals, as well as other customary closing conditions.

Per the terms of the merger agreement, AV will issue approximately 18.5 million shares of AV common stock to BlueHalo.

Following the close of the transaction and based on AV’s shares outstanding as of November 18, 2024, AV’s shareholders will own approximately 60.5% of the combined company and BlueHalo’s equity holders will own approximately 39.5%, subject to closing adjustments. Arlington Capital Partners, an investment firm that is the majority owner of BlueHalo, will retain a significant ownership stake in the combined company.

All BlueHalo holders expect to enter lock-up agreements with respect to their transaction consideration, with 40% releasing 12 months post close and the remaining 60% to be released in equal tranches 18 and 24 months after the close.

Leadership, Governance, and Headquarters

Following the completion of the transaction, AV Chairman, President and CEO Wahid Nawabi will be Chairman, President and CEO of the combined company. Jonathan Moneymaker, CEO of BlueHalo, will serve as a strategic advisor to Mr. Nawabi and the combined company Management Team.

Upon closing, the AV Board of Directors will be expanded to comprise 10 members. Arlington Capital Partners will have the right to appoint two directors to the Board, subject to minimum ownership thresholds.

The combined company will be headquartered in Arlington, Virginia, at AV’s corporate headquarters.

Latest from Defense and Munitions

- Immersive Wisdom awarded Air Force contract for digital war room software

- Fusion Tools's LockJaw synthetic lifting shackle

- IMTS 2024 Booth Tour: Marubeni Citizen-Cincom, Inc.

- Sigma Defense opens new office in Lexington Park, Maryland

- FDH Electronics signs distribution agreement with Amphenol Military High Speed

- AeroVironment's advanced software updates

- Digital Transformation in 5-Axis Machining

- U.S. Navy, Lockheed Martin Skunk Works demonstrate first live control of an uncrewed air vehicle